The daily business briefing: November 8, 2018

Stocks rise in a sign of post-election relief, China's exports beat expectations despite the U.S. trade war, and more

- 1. U.S. stocks gain on post-election relief

- 2. China exports beat expectations despite tariffs

- 3. Health and cannabis stocks boosted by election results

- 4. Trump administration issues rules seeking to let employers deny birth control coverage

- 5. Tesla names board member Robyn Denholm to replace Elon Musk as chairman

1. U.S. stocks gain on post-election relief

The Dow Jones Industrial Average surged by 545 points or 2.1 percent on Wednesday, signaling investor relief after the midterm elections ended with a divided Congress as expected. The S&P 500 also rose by 2.1 percent, and the Nasdaq Composite jumped by 2.6 percent. It remains to be seen how President Trump will approach governing in a divided Washington. World stocks mostly gained for an eighth straight day on Thursday, buoyed by encouraging economic data from China and relief over the results in the U.S. midterms. Traders are looking next for news from the Federal Reserve, which concludes a two-day policy meeting on Thursday. The U.S. central bank is expected to keep interest rates unchanged but signal the economy remains on a track that will justify the next rate hike in December.

2. China exports beat expectations despite tariffs

China on Thursday reported October exports and imports that exceeded forecasts despite new U.S. tariffs, rising 16 percent over the same month last year. The data came as a surprise because October was the first full month since the Trump administration escalated its trade war against China by starting to collect new tariffs on $200 billion of Chinese imports. One reason for the rise was that some exporters were rushing through U.S. orders to avoid higher future levies. Economists expect China's export growth to slow through the end of the year. China showed a $31.8 billion trade surplus with the U.S., down from a record $34.1 billion in September. China's total surplus with the U.S. so far this year reached $258 billion.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Health and cannabis stocks boosted by election results

Health insurance stocks rose sharply on Wednesday as investors bet that Republicans would not be able to repeal the Affordable Care Act after Democrats seized control of the House in Tuesday's midterm elections. UnitedHealth, the biggest insurer, gained 4.2 percent; Anthem rose by 6.6 percent; and HCA, the largest hospital company, jumped by 4.7 percent. The health law, commonly referred to as ObamaCare, expanded health insurance to millions of Americans, boosting the health-care industry. Cannabis companies also gained on Wednesday after several states voted to partly legalize marijuana. Shares of New Age Beverages Corp., which is expanding into cannabis products, rose by 20.1 percent. U.S. shares of Canadian companies Canopy Growth Corp., Aurora Cannabis Inc., and Cronos Group Inc. gained between 8 and 10 percent.

4. Trump administration issues rules seeking to let employers deny birth control coverage

The Trump administration issued federal rules on Wednesday letting some employers deny insurance coverage of birth control if they object to it for religious or moral reasons. The Obama administration interpreted the Affordable Care Act as requiring the coverage at no charge to consumers because birth control qualified as an essential health benefit. The Trump administration a year ago proposed getting around the mandate with a rule change as part of its response to social conservatives who called the Obama-era policy a violation of "religious liberty." The draft rules sparked immediate protests from Democrats, state attorneys general, civil liberty groups, and women's rights advocates. Federal judges in Pennsylvania and California have granted nationwide injunctions against the proposals while they consider lawsuits filed by attorneys general, so the new rules are in limbo.

5. Tesla names board member Robyn Denholm to replace Elon Musk as chairman

Tesla late Wednesday named board member Robyn Denholm as its new chairman, replacing CEO Elon Musk as the board's leader. The announcement came ahead of a Nov. 13 deadline to install a new board leader under Musk's settlement with the Securities and Exchange Commission to end claims he misled investors by tweeting he had lined up investors to possibly take the electric car maker private. Musk had served as chairman since Tesla's early days. Denholm, the chief financial officer of Australian telecommunications firm Telstra Corp., has been on the board since 2014, but is considered less closely tied to Musk than other board members.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

AI is causing concern among the LGBTQ community

AI is causing concern among the LGBTQ communityIn the Spotlight One critic believes that AI will 'always fail LGBTQ people'

By Justin Klawans, The Week US Published

-

'Modern presidents exercise power undreamed of by the Founding Fathers'

'Modern presidents exercise power undreamed of by the Founding Fathers'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

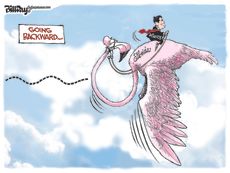

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

By Harold Maass, The Week US Published

-

Geopolitics and the economy in 2024

Geopolitics and the economy in 2024Talking Point The West is banking on a year of falling inflation. Don't rule out a shock

By The Week UK Published

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

By Harold Maass, The Week US Published